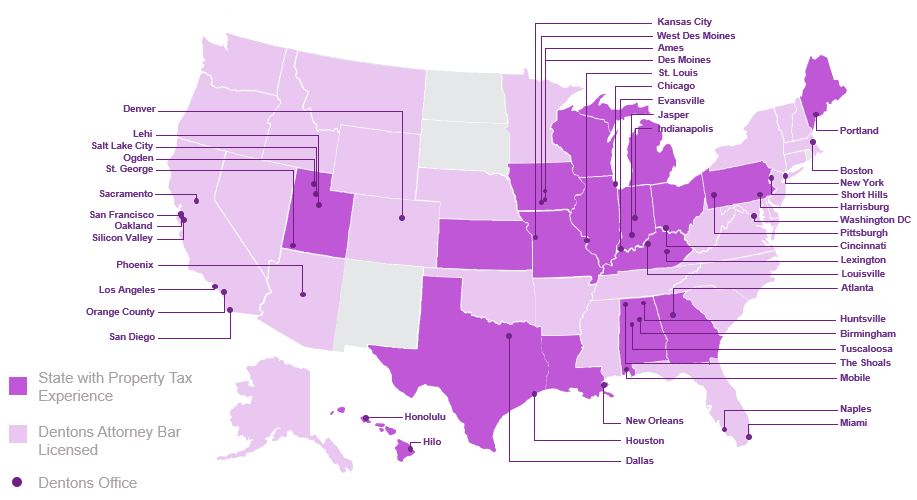

The Dentons Property Tax team assists clients in numerous states across the U.S. with property tax related issues and solutions affecting real property and personal property. Our property tax lawyers have experience in representing commercial property taxpayers in administrative and appellate litigation, including real estate and personal property assessment appeals, valuation issues, requests for tax exemption, audit defense, defense of tax sale proceedings, and equalization and compliance cases.

Several of our property tax lawyers have litigated some of the largest property tax disputes in their markets before local county boards statewide, state departments of tax and revenue, state tax adjudicative tribunals (e.g., state board of tax appeals) and courts (e.g., state tax courts), and state appellate courts up to the US Supreme Court.

Clients have trusted the members of the Dentons Property Tax team to manage challenging and complex property tax issues that affect diverse industries, ranging from utility companies and petroleum/chemicals refining companies to major retailers, manufacturers, health care facilities and vessel operators.

Our experience:

Delta Air Lines, Inc.: Represented international and domestic airline before the Utah Supreme Court involving a challenge by Salt Lake County – the county in which all of Delta’s Utah property value is located – to the constitutionality of a 2017 Utah statute that requires the Utah State Tax Commission to use a preferred valuation methodology to assess airline property. Depending on the outcome of the County’s appeal and the fluctuating assessment of Delta’s property each year, the difference in assessed value between the 2017 statute and the County’s preferred valuation methodology, could be several million dollars in taxes each year. Salt Lake Co v. Tax Commission, Case No. 20210938, Filed November 09, 2023, 2023 UT 24, superseded by amended opinion, Filed April 18, 2024, 2024 UT 11; Salt Lake Cnty v. State of Utah, Case No. 20180586, Filed May 18, 2020, 2020 UT 27.

Kroger Limited Partnership I: Represented as lead counsel the national grocery store chain in a property tax case involving a big box grocery store, holding in favor of Kroger. Kroger v. Jenkins, No. K16-S-07 (Ky. B.T.A. July 12, 2016), aff’d, No. 16-CI-00435 (Ky. Cir. Ct. 2019), rev’d, No. 2019-CA-001133, 2020 WL 4554866 (Ky. Ct. App. July 17, 2020); Kroger v. Jenkins, No. K16-S-07 (Ky. B.T.A. June 18, 2021) (adopting Kroger’s value for big box grocery store).

LaRue County Geriatric Center: Represented as lead counsel this skilled nursing provider in a property tax dispute involving a leased nursing home. LaRue Cnty. Geriatric Ctr. v. LaRue Cnty. Prop. Valuation Adm’r, No. K16-S-76 (Ky. Claims Comm’n 2017).

Walgreen Co.: Representing as lead counsel the national drug store chain in a challenge regarding the fair cash value of leased property and constitutional claims of equal protection and uniformity violations. LWAGLVKY 1, LLC v. Jefferson Cnty. Prop. Valuation Adm’r, Nos. K19-S-88, 207–210 (Ky. B.T.A. Aug. 25, 2021), aff’d, No. 2021-CI-005434 (Jefferson Cir. Ct. Feb. 22, 2024), appeal docketed, No. 2024-CA-0302 (Ky. App. Mar. 12, 2024).

The Solomon Foundation: Representing as lead counsel the non-profit religious institution in a challenge regarding the property tax exemption for religious institutions of Kentucky Constitution Section 170. Solomon Found. v. Dunn, No. 19-S-27 (Ky. B.T.A. 2021), rev’d, No. 21-CI-00191 (McCracken Cir. Ct. 2022), aff’d, 2022-CA-0399 (Ky. App. Apr. 28, 2023), and 2022-CA-0401 (Ky. App. Apr. 28, 2023), appeal docketed, No. 2023-SC-0235 (Ky. Oct. 18, 2023), and 2023-SC-0236 (Ky. Oct. 18, 2023). Also represented a church in a first impression case concerning the 1990 amendment to Section 170’s exemption for religious institutions cited in The Solomon Foundation. Freeman v. St. Andrew Orthodox Church, Inc. S.W.3d 425 (Ky. 2009).

Property Tax Team