What is a State Transfer Pricing Audit?

Transfer pricing is a growing and contentious issue for states trying to protect their tax revenues. In response, many states have increased their efforts to curb revenue loss through increased transfer pricing audits and examining intercompany transactions.

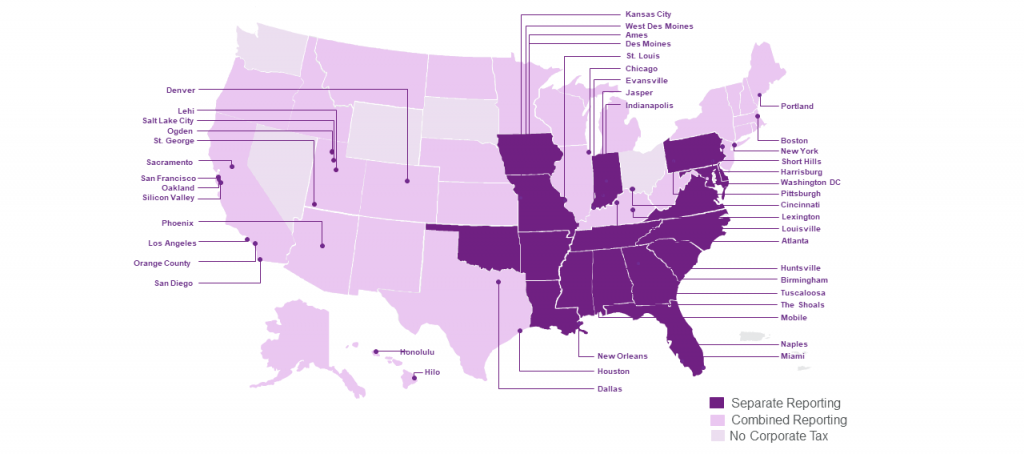

Broadly, transfer pricing focuses on the pricing of intercompany transactions and the allocation of income and expenses between related entities. State Department of Revenues (DOR), focused on capturing lost revenues, are prepared to audit more intercompany transactions between related parties.[1] Most of the new audits are expected to be focused in the 17 separate-reporting states, which allow each business entity to submit a tax return separate from its affiliated group.[2] Whereas, in the 28 combined-reporting states, the parent company and all of the subsidiary companies are treated as one entity for state income purposes.

When entities file separate tax returns, states are concerned that entities could understate income when transferring an asset by selling the asset intercompany for an amount lower than the market value that would be received in an arm’s length transaction, potentially evading DOR review.

For example, Company A in State A and Company B in State B are both wholly owned subsidiaries of Company P. Typically, Company A sells Product A for $50, but sells Product A to Company B at the $30 cost imposed on Company A for Product A. State A’s DOR may argue that Company A should have charged Company B the established arm’s length price of $50 and increase Company A’s State A taxable income by the $20 difference. The product provided by Company A to Company B could be tangible or intangible, a product or a service.

How States Flex Their Audit Powers

On audit, DORs use their states’ version of Internal Revenue Code section 482, which states that affiliated companies must price intercompany transactions as if it was an arm’s length transaction, or force the company to file as if it were a combined-reporting state to increase the state’s bottom line.

Some states created programs to quickly resolve transfer pricing issues and incentivize companies to voluntarily be audited. In Louisiana taxpayers could resolve any transfer pricing dispute without paying the associated penalties and interest.[3] In exchange for voluntarily coming forward, DORs in such states may look to audit other companies instead of focusing on the companies that volunteered.

As society continues to innovate so do states. State Department of Revenues have increased their investment in auditing mechanisms to detect and prevent transfer pricing abuses. New and sophisticated audit techniques continue to be introduced in an attempt to identify potential transfer pricing schemes and abuses. Additionally, cooperation amongst states has gained traction and is expected to continue in the future.

Steps You Can Take to Reduce the Risk of Audit:

Due to the wide range of transactions that could be audited for transfer pricing, it is important for affiliated companies to review intercompany transactions. Is the price comparable to the price of an arm’s length transaction (i.e., if the transacting parties were unrelated, would the parties agree to that price)? Does the transaction comply with existing contracts between the parties?

Companies should continuously and contemporaneously review and update the records associated with intercompany transactions. Such intercompany agreements should be as detailed as one would be with an unrelated party, specifically identifying the exchange and fee. Taxpayers with questions on how state transfer pricing audits may affect them should consult with their tax advisors.

[1] Michael J. Bologna, States Ramp Up Transfer Pricing Audits in Search of Tax Revenue, Bloomberg (Sept. 18, 2023 3:50 PM), https://news.bloombergtax.com/daily-tax-report-state/states-ramp-up-transfer-pricing-audits-in-search-of-tax-revenue (“A number of state tax departments are gearing up to scrutinize transactions between units of multistate businesses”).

[2] Id. (“Most of the heat is concentrated in ‘separate-reporting states’… 17 separate-reporting states permit tax returns for each business entity in an affiliated group”).

[3] Id. (“Louisiana Department of Revenue recently finished its Transfer Pricing Managed Audit program, which allowed taxpayers to resolve disputes with the state on an expedited basis without paying any penalties and interest.”). CITE directly to the Louisiana program.